There are worrying signs that the war on cash is not going well…Payments Cards & Mobile recently reported that in the UK consumers are switching back to cash in a bid to keep tighter control on their spending as living costs soar.

According to new research by the Post Office it handled £801 million in personal cash withdrawals in July, the most since records began five years ago, up more than 20% from a year earlier.

The ECB also just released its findings that despite massive gains by electronic payments providers, cash is still the most frequently used means of payment at POS, cash was used for 59% of POS transactions in 2022, down from 72% in 2019.

Now, further research by the UK largest building society Nationwide, shows that cash usage has increased for the first time in 13 years.

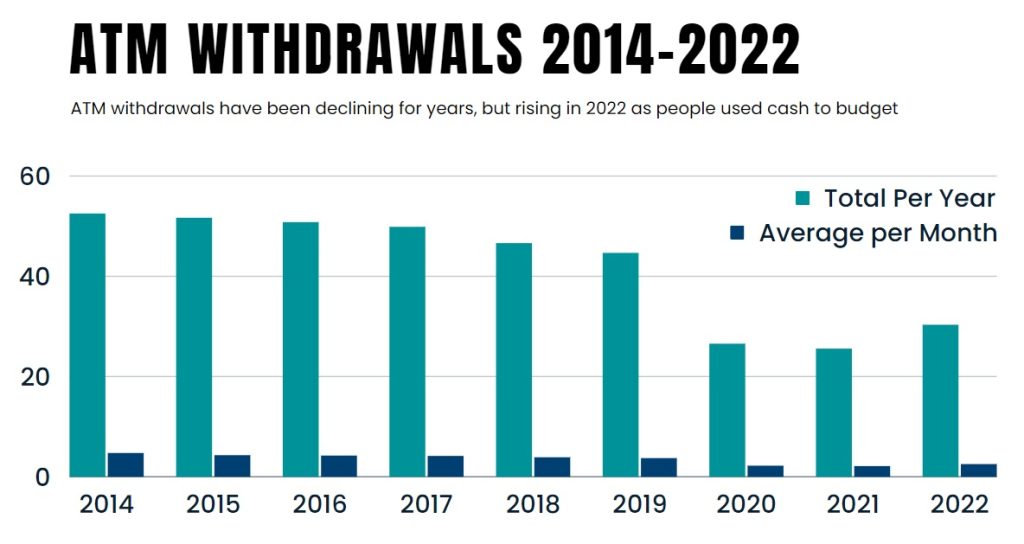

It revealed that more than 30.2 million withdrawals were made from Nationwide ATMs last year – a 19% rise on 2021. Over recent years the number of withdrawals has been steadily declining.

At the start of the pandemic, the number of withdrawals at Nationwide ATMs dropped more than 40% in a year.

Nationwide believes people are now returning to cash to better cope with the rising cost of living.

“For the first time in years we are seeing a natural rise in withdrawals as people return to using cash to help avoid getting into debt from the rising cost of living,” says Otto Benz, director of payments at Nationwide Building Society.

The average amount of cash withdrawn from Nationwide ATMs was £105 last year, down 2% on the previous year but still up 25% on 2019.

When it comes to the depositing of cash, over the last five years Nationwide has seen a 34% increase in the number of times its ATM machines are used, with the average amount deposited rising to £277, a 37% increase on five years ago.

“Far from the end for cash, it shows that the future of money management is constantly evolving,” said Benz.