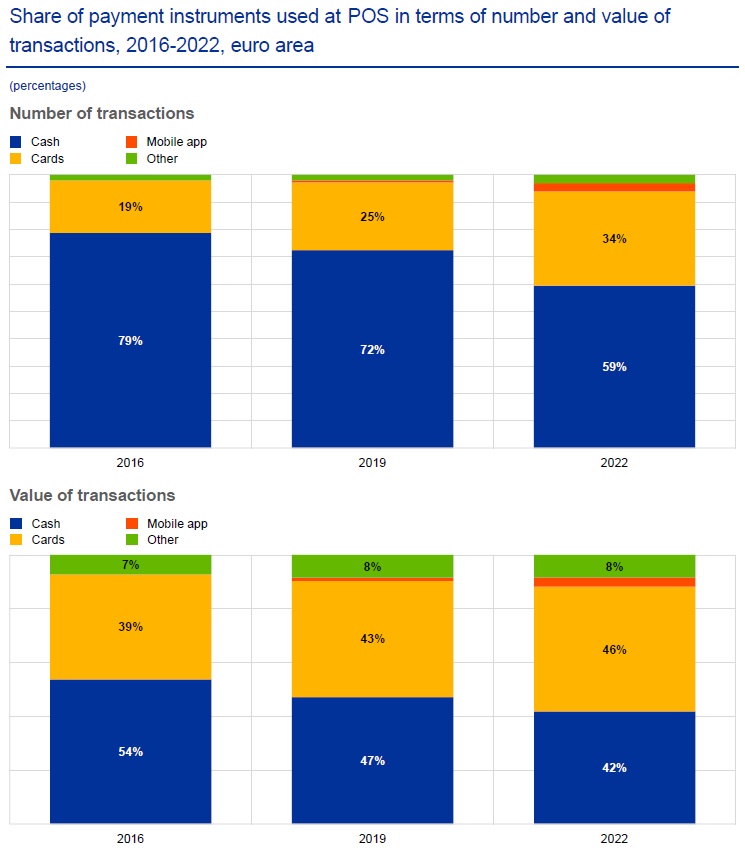

Cash is still the most frequently used means of payment at POS, but its share is declining according to the latest study on the payment attitudes of consumers in the euro area, published by the European Central Bank (ECB).

Cash was used for 59% of POS transactions in 2022, down from 72% in 2019.

It is the means of payment most often used for small-value payments in stores and for person-to-person transactions.

When measuring POS transactions in terms of value, the share of card transactions in 2022 (46%) was higher than the share of cash transactions (42%) for the first time.

In 2019 the share of cash transactions by value was 47% and the equivalent share of card transactions 43%.

Consumers were making payments using mobile phone apps more often than before.

However, their share in total POS payments was still relatively low compared to cash and card payments. Mobile phone payments accounted for 3% of the number of transactions in 2022 (up from 1% in 2019) and 4% of the value (up from 1%).

A majority (60%) also consider it important to have cash as a payment option. Consumers perceive cash as helpful to remain aware of their expenditures, to protect their privacy and to allow transactions to be settled immediately.

Overall, consumers are satisfied with their access to cash, with a large majority of consumers finding it easy to get to an ATM or a bank to withdraw cash in most countries.

At the same time, the trend towards electronic means of payments has accelerated with the pandemic and a majority of consumers now prefer to use electronic payment methods.

The share of online purchases as a percentage of all euro area day-to-day transactions has increased significantly to stand at 17% in 2022, up from 6% in 2019.

For purchases at POS, the share of card payments has grown by 9 percentage points to 34% in 2022, with contactless payments now making up the majority of card payments.

Cards are considered faster and easier to use and are seen as reducing the need to carry large amounts of cash.

Cards are the most frequently used payment method for larger payments and account now for a higher share of payments than cash in value terms.

“The ECB is committed to ensuring that consumers remain free to choose how to pay, both now and in the future,” said Executive Board member Fabio Panetta.

“We are seeing confirmation of strong demand for both cash and digital payments. Our commitment to cash and our ongoing work on a digital euro aims to ensure that paying with public money is always an option.”