A new study from leading European payment specialists Transact Payments reveals Brits overwhelmingly prefer to carry cash and use cards.

Cash and cards still king

Although digital wallets and other “alt” payments are making inroads, trust remains an issue with 56% of Brits saying they do not trust digital wallets as a payment method, and just over a third actually using digital wallets.

Cash, ATMs and branches: convenience and security

Based on an April 2022 survey of 1,000 UK adults from all regions of the UK, UK payments in transition to digital found 73% of UK consumers still carry cash.

Middlesbrough (at 92%) is the cash-carrying capital of the UK, followed by Cambridge (91%) and Exeter (90%). Most consumers prefer to use both cards and physical cash for payments.

The vast majority of Brits are concerned about the impact a cashless society would have on their elderly family and friends: 71% believe the elderly would be “cut off from society” if the UK moves to a fully cashless society.

Meanwhile, two-thirds of respondents would be worried if their area had no physical bank branches in five years’ time, though most do not use bank branches frequently and appreciate the reassurance and convenience of having a branch available.

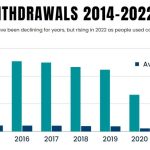

Some 40% of respondents to this survey still use ATMs a few times a month, while more than one in five (22%) use ATMs even more frequently. More than three-quarters of Britons believe the UK will still have an ATM network in five years’ time.

Digital wallets, crypto and the Metaverse: Brits uncertain

Despite much focus on a potential “Britcoin”, the study from shows just 6% want to see the UK have a digital currency in the future.

Going beyond crypto into a future “metaverse” in which all manner of activities – from software development to listening to music – can be created and paid for virtually, fully seven in ten Brits say they are not sold on the concept of payments in the metaverse.

Londoners are the only region to say they would be “comfortable” making such a payment, with 52% of those surveyed in the capital liking the idea.

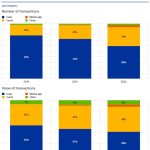

While just over a third (34%) use digital wallets, usage is heavily skewed towards the young. Almost two-thirds (64.3%) of the 18-34 generation use digital wallets, compared to fewer than one in five of the 54-65 age bracket.

Apple dominates the market for digital wallet users at 46%, followed by PayPal (41%), while Google Wallet (at 9%) and Samsung Pay (3.2%) lag way behind.

Making sense of consumer attitudes to payments

Transact Payments’ study sets out a range of recommendations for payments companies and banks to consider, including preparing for a future in which older generations form a larger part of the population.

The implication is that those involved in the payments business should continue to invest in modern card management platforms and more powerful and secure cards.

At the same time, financial institutions and payments service providers (PSPs) should consider their options for continuity in cash handling, management of an ATM estate and the ability to accept and process payments using cash and cards.

In that regard, this study notes the significance of the UK government’s recent commitment to bring in legislation that guarantees access to cash – and predicts that there’s still much life left in the UK’s cash handling, ATM and card acceptance networks.

For further detail and more strategic recommendations from Transact Payments click here to download a full copy of the report