The Covid-19 pandemic had a significant impact on people’s payment habits, with cash use falling significantly, and by more than other payment types. This has led to some concerns that Covid has hastened the demise of cash.

But since coming out of lockdown, we have seen a sustained, if partial, recovery in cash use, and more recently, a stabilisation in cash use trends.

Moreover, the value of banknotes in circulation remains elevated even two years on from the pandemic, at close to a historic high. This reflects people – up to 60% of the population – holding more cash as a store of value, which is a fundamental role of money.

This below reviews recent data trends and survey evidence to consider where cash usage might head next.

While the future trajectory remains uncertain, both in terms of the speed and extent of future decline, what is certain is there remains a significant group of people, with varied characteristics, who value cash.

Overview

For a number of years, people in the UK have been using less and less cash as part of their everyday spending. But the total value of notes in circulation (NIC) has actually increased as people choose to hold more cash. These trends have persisted for a number of years and have been amplified by the Covid pandemic.

In November 2020, the Bank of England published a Quarterly Bulletin article that explored cash trends in the early days of the pandemic.

As we enter a ‘post-lockdown’ world, this article takes a look at how cash use and cash demand have evolved, and the possible drivers of these trends – both from a transactional and store of value perspective.

We find that, while Covid has had a lasting impact, with some permanent shifts in payment habits towards digital payment methods, cash use has proved resilient, perhaps surprisingly so.

There has been a partial recovery in the transactional use of cash, and the value of NIC remains elevated two years on from the start of the pandemic, reflecting people holding more cash as a store of value.

Cash therefore continues to be an important form of money for many – one in five people – consider it to be their preferred payment method and 1.1 million people rely on it for their everyday spending. Even for those who may not use it day-to-day, cash remains an important back-up option.

Transactional use of cash

What has been the impact of Covid on cash use trends?

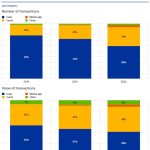

Prior to the pandemic, the UK had experienced a marked decline in the use of cash to pay for goods and services.

Only 23% of payments in 2019 were made in cash, down from around 60% a decade ago. In 2020 when the pandemic was in its early stages, this figure dropped by 35% compared to 2019, with cash accounting for 17% of all payments.

Since 2017 cash use had been declining by around 15% each year, so 2020 represented an acceleration of this decline.

There has since been a sustained, if partial, recovery in cash use, and more recently, signs of stabilisation in cash use trends.

In 2021, there was a reduction in the rate of decline in cash use, with cash accounting for 15% of all paymentsOpens in a new window in the UK. Moreover, an estimated 73% of consumers said they used cash in January 2022, a notable increase from only around half of consumers in mid-2020.

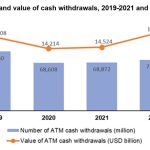

The recovery in cash use can also be seen in ATM withdrawals (Chart 1). These fell sharply at the start of the pandemic: overall withdrawal values decreased by 50%, with even larger falls in city centres and transport hubs.

Since then, consumers have been withdrawing more cash, and overall cash use has been largely stable since around mid-2020, hovering at about 30% below pre-pandemic levels.

This suggests that, at least in the near term, cash use has stabilised.

ATM withdrawals have recovered but remain below pre-pandemic levels

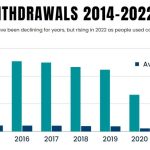

Given cash use was on a declining trend prior to the pandemic, it is worth considering the additional impact of the pandemic on cash use.

By extrapolating the declining trend in ATM withdrawal values in the years before the pandemic (Chart 2), we find that, in 2022 Q2, ATM use was around a fifth down on where it might otherwise have been.

This suggests that Covid has accelerated the pre-pandemic trends seen in cash use, and may have brought forward cash decline by over five years, reflecting a change in people’s payment preferences.

ATM withdrawal values are around a fifth down on where they might otherwise have been had the pandemic not happened

What remains highly uncertain is where cash use will head next.

On the one hand, Covid appears to have brought forward, and accelerated the rate of change in payment preferences.

On the other, if those who were most likely to change their behaviour already have, then the pace of change may actually slow. UK Finance expect this to happen, and predict that by 2031, 6% of all payments will be made in cash.

Understanding what influenced demand during the pandemic, and subsequent recovery, might offer some clues about cash’s future trajectory.

The latest data from the Post Office reveal cash withdrawals at Post Offices for personal cash withdrawals in October were up over 12% year-on-year with £777 million withdrawn over the counter at its 11,500 branches.

In Northern Ireland, personal cash withdrawals in October were up 25% year-on-year (£54.3 million, October 22 compared with £43.5 million, October 21).

In total, Post Offices handled £3.26 billion in cash withdrawals and deposits in October. This was slightly down on the £3.35 billion handled in September.

Personal cash deposits totalled £1.35 billion in October. This was a 6% fall month-on-month (£1.43 billion, September 22) and up over 12% year-on-year (£1.2 billion, October 21).

Business cash deposits totalled £1.1 billion in October, almost identical to September, and up over 10% year-on-year (£1 billion, October 21).

Post Office attributes the continuing high levels of cash withdrawals to the on-going closure of local bank branches, with people turning to the Post Office to support them with their cash needs.