UK consumers are switching back to cash in a bid to keep tighter control on their spending as living costs soar, according to new research by the Post Office.

Cash returns to top of wallet

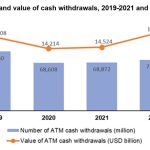

Post offices handled £801 million in personal cash withdrawals in July, the most since records began five years ago, up more than 20% from a year earlier.

Natalie Ceeney, chair of the Cash Action Group, said it showed people are “literally counting the pennies” as they grapple with rising prices.

“It’s absolutely because of the cost of living crisis,” said Ms Ceeney, who chaired the government’s independent Access to Cash review.

“People will be taking it out and physically putting it into pots, saying “this is what I have for bills, this is what I have for food, and this is what’s left.”

Prices are currently rising faster than they have for 40 years.

In total, £3.32 billion in cash was deposited and withdrawn at Post Office counters in July, £100 million higher than in June.

Personal cash withdrawals, at £801 million, were up almost 8% month-on-month and up more than 20% year-on-year.

It is the highest amount since records began five years ago, and only the second time that personal cash withdrawals have exceeded £800 million. The last time was December 2021, and there’s always an increase in withdrawals around that time of year, the Post Office said.

The Post Office put the extra volume of withdrawals at its 11,500 branches down to more people turning to cash to help manage their budgets on a week-by-week and often a day-by-day basis.

More and more cash

“We’re seeing more and more people increasingly reliant on cash as the tried and tested way to manage a budget” explains Martin Kearsley, banking director at the Post Office.

“Whether that’s for a staycation in the UK or if it’s to help prepare for financial pressures expected in the autumn, cash access in every community is critical.”

Cash deposits also rose, according to the research.

Individuals deposited £1.35 billion in cash in July, up 2% month-on-month, while cash deposits for businesses totalled £1.13 billion, up 1.9% from a month earlier.

Mr Kearsley said the figures showed Britain is “anything but a cashless society”.

Ms Ceeney added that it was easy to see why cash use was going up, given the rising cost of living.

“Cash has been in decline for well over a decade, the pandemic accelerated this, but now it’s going back up,” she said.

“It helps people budget, as using it means you literally can count the pennies. We all know that if you pay with a card, it’s so easy to spend money you don’t have and then go overdrawn.

“If you’ve only got £30 to last you the week, holding that in notes and coins is still the most effective way of budgeting and controlling how much you spend.”

With more banks closing branches, Ms Ceeley said there’s a need for post offices and shared banking services to allow people to get the cash that they need, especially for vulnerable or elderly people or those who don’t have access to digital banking.

“The reality is digital doesn’t work for everyone,” she said.