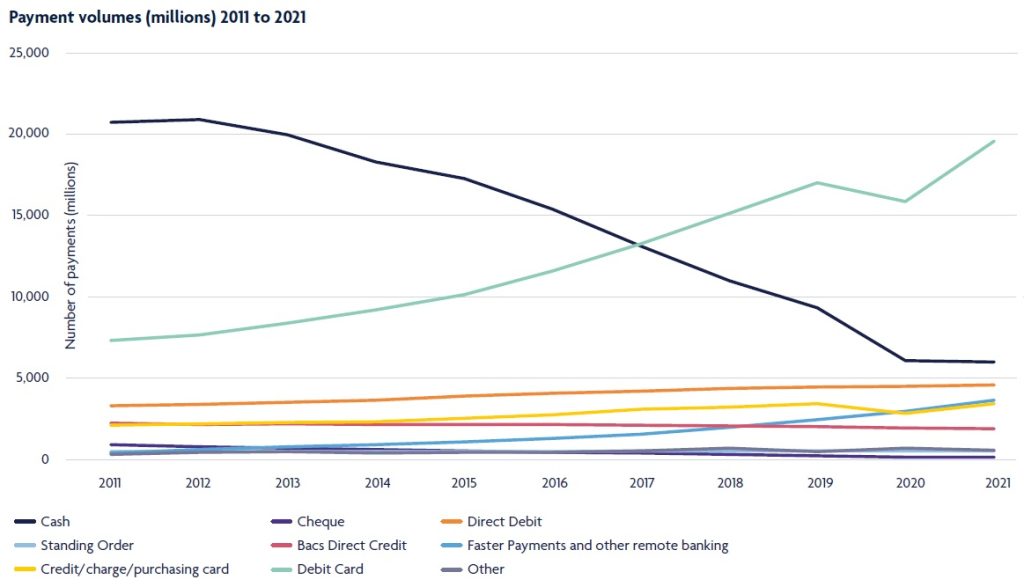

In the last couple of years the global Covid-19 pandemic and associated lockdowns have led to significant changes in patterns of the UK payments market.

Lockdowns resulted in large sections of the economy shutting down completely for parts of the year. In those parts of the economy which remained operational, many businesses switched to home working arrangements, reducing expenditure on travel and city centre spending.

As a result of these measures, 2020 saw a significant fall in the number of payments made in the UK.

However, as lockdown restrictions were lifted during 2021, the economy reopened and the total number of payments made returned to pre-pandemic levels.

Data from 2021 suggest that trends in payments behaviour have returned towards their pre-pandemic patterns. Both debit card and credit card payments, which had declined in 2020, rose once again in 2021.

Further, the share of payments made using cards, which had increased to 52% of all payments during 2020, continued to increase in 2021, with 57% of all payments in the UK being made using cards in 2021.

Contactless payments continued to be popular, with almost a third (32%) of all payments made in the UK during 2021 being made using contactless.

Considering cash, the experience of the past couple of years has shown interesting impacts due to the pandemic. The long-run trend in cash payments over the past decade has been of a continuing decline, with payments transitioning in particular to debit cards.

In 2020, the pandemic resulted in cash use falling by 35% compared to the previous year. Since 2017 cash use had been declining by around 15% each year, so 2020 represented an acceleration of this decline.

In 2021, it appears that there was a reduction in the rate of decline in cash use. Much of this was to be expected; many parts of the economy with traditionally high levels of cash usage were closed or heavily restricted during lockdown, and in those parts of the economy that remained open, many retailers encouraged the use of contactless payment options, amid fears about cash being a vector for Covid-19 transmission.

The reopening of the economy and lessening of fears about Covid-19 transmission appear to have led to a reduction in the rate of decline, particularly when compared with the experience of 2020.

Having said this, the total number of cash payments made in the UK during 2021 still declined by 1.7% compared with 2020.

Cash remains the second most frequently-used payment method in the UK, being used for 15% of all payments made during 2021.

Throughout the Covid-19 pandemic, strong growth was seen in Faster Payments, and this continued in 2021. Both businesses and consumers increasingly used online and mobile banking to make payments and to transfer money.

Mobile banking in particular continued to grow strongly among consumers, with customers extending their use beyond just checking balances to now making payments and managing their finances more generally.

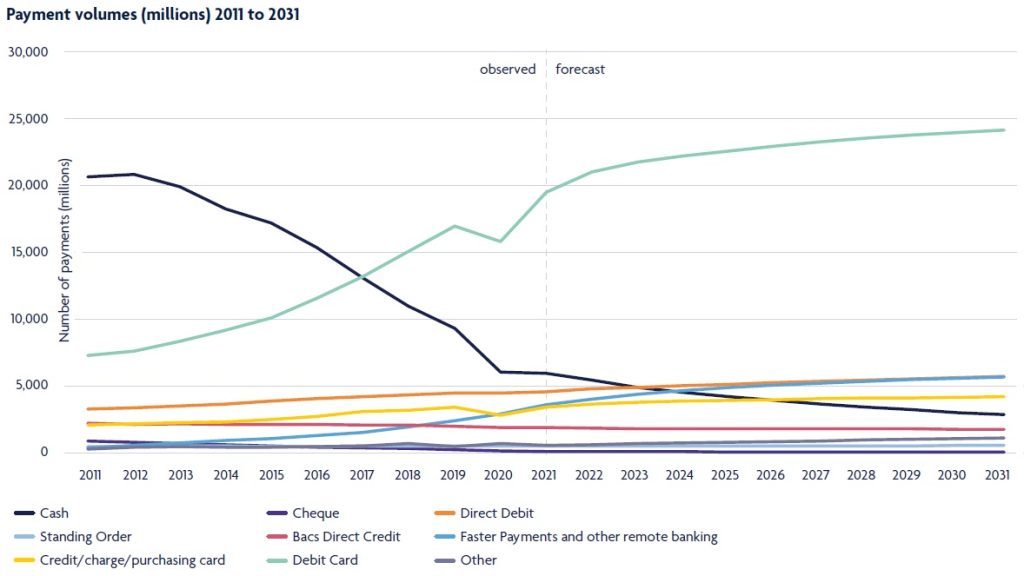

Over the next decade further market developments, such as those brought about through Open Banking and the anticipated New Payments Architecture for the UK, may bring extensive changes to the UK’s payments landscape.

UK payments market: Payment volumes (millions) 2011 to 2021

A total of 40.4 billion payments were made in the UK during 2021. This represented a return to pre-pandemic payment volumes, after a significant fall in 2020 due to the successive Covid-19-related lockdowns.

Nearly nine out of ten payments were made by consumers. Spontaneous purchases accounted for 83% of payments made by consumers, with the other 17% of their payments being made for regular bills and commitments.

Commercial organisations, government and not-for-profit organisations (collectively referred to using the shorthand “businesses” throughout this report) made just over 5.5 billion payments during 2021, a 14% increase compared with 2020.

Payments to individuals accounted for 46% of all payments made by businesses, with the other half being payments to other businesses. There are a wide variety of payment methods available in the UK.

Each payment method provides specific benefits to the participants in the transaction. Payers generally choose the method that best meets their needs in any given situation, albeit sometimes influenced by the preferences of the payee.

UK payments market: Debit cards

Overall debit card payment volumes had declined in 2020 due to the pandemic, but payment volumes rebounded in 2021 with growth of over 23% to reach a total of 19.5 billion payments.

As a result, debit cards consolidated their position as the most frequently used payment method in the UK, responsible for nearly half (48%) of all payments made in the UK during 2021.

The overwhelming majority of the population (97%) now hold a debit card and the majority of people use them to make payments.

Throughout 2021, contactless payments continued to grow in popularity, contributing to the ongoing increase in use of debit cards and the migration of payments away from cash.

Debit cards are also one of the main payment methods used to pay for online shopping, something which was boosted by periods of lockdown in the UK. Over the next decade, debit card payment volumes are forecast to continue to increase in use.

They are predicted to pass the threshold of accounting for more than half of all payments in the UK, reaching over 24 billion payments in 2031. This growth will be driven by the continuing rise of contactless payments, the ongoing growth of online shopping and ever-increasing levels of card acceptance amongst businesses of all sizes, but particularly amongst smaller businesses.

UK payments market: Credit cards

There were 3.4 billion payments made using credit cards in 2021, an increase of 21% compared to the previous year, reflecting credit card payments returning almost to their pre-pandemic levels.

Spending had previously declined due to (a) lockdowns closing sectors of the economy with high credit card spend (such as holidays, travel and entertainment), (b) restrictions on international travel that affected both the leisure and business travel sectors, and (c) reductions in consumer confidence.

As lockdowns were relaxed during 2021, opportunities to make payments using credit cards increased. Having said this, consumer confidence has not returned to pre-pandemic levels, and cost-of-living fears in particular may be making consumers more cautious about taking on additional unsecured debt.

Concerns about energy and food price increases in particular first emerged in the autumn of 2021 and may have had an impact on use of consumer credit.

By 2031 credit card payment volumes are forecast to reach 4.2 billion payments. Future growth will be closely tied with wider economic conditions, which determine consumer appetite for taking on unsecured debt.

UK payments market: Contactless payments

During 2021 the number of contactless payments made in the UK increased by 36% compared with 2020, to reach 13.1 billion payments.

This was driven by:

- Contactless limit increase to £100

- Some retailers continuing to encourage consumers to use contactless at point-of-sale

- The continued roll-out of card acceptance devices especially among smaller businesses

- Consumers becoming increasingly comfortable and familiar with making contactless payments

- Continuing growth in popularity of mobile contactless payment services such as Apple Pay and Google Pay

At the end of 2021 there were 142 million contactless cards in circulation, with 91% of debit cards and 89% of credit/charge cards in the UK having contactless functionality.

Since January 2020, every bank-issued payment terminal in the UK has been capable of accepting contactless payments. Along with many smaller businesses now accepting card payments, this has increased the number of locations where consumers can pay using contactless.

During 2021 supermarkets were the most popular location to make contactless payments payments, accounting for accounting for two-fifths (41%) of all contactless payments. Retail in total accounted for three quarters (75%) of all contactless payments made in the UK.

Contactless payments are used extensively throughout the UK in 2021, with 86% of people making contactless payments at least once a month or more frequently. People of all ages used contactless payments, and even when considering people of retirement age, around eight out of ten (78%) used contactless at least once a month.

The group showing the highest rate of use was the 25-34 age group, where nine out of ten (92%) of people regularly made contactless payments. Though differences remain across age group and region, the majority of people in all age groups and across all regions make contactless payments.

As well as using contactless cards, other devices such as mobile phones and watches can be used to initiate contactless payments, or to make payments for online shopping. Nearly a third (32%) of the adult population reported being registered for at least one mobile payments service in 2021.

Of those registered for mobile payments 92% of these people used the services to make payments during the year. Seven out of ten (70%) of these registered users made payments every month.

For more information on the UK payments market CLICK HERE