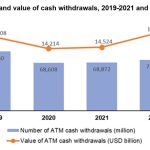

The use of cash around the world dropped by one-third last year according to the World Payments Report 2022.

Digital wallets are transforming emerging markets

This huge reduction in cash use happened as growing numbers of consumers in emerging markets turned to digital wallets for their financial needs.

While digital wallets bring many benefits to individual users, they also help to modernise emerging market economies and boost economic growth.

According to the World Bank, some 1.7 billion individuals – almost one in four of the people on the planet – are unbanked.

Around three-quarters of these people are based in emerging markets – and they are adopting digital wallet technologies as their entry point to a global digital economy.

Digital wallets make sense in emerging markets, where traditional financial infrastructure can be outdated or poorly distributed and reliance on cash is high.

These factors inhibit economic growth, in particular reliance on cash, which slows down transaction times and encourages the persistence of a “grey” economy outside the formal banking and taxation systems.

Connecting people, invigorating growth

In their Sustainable Development Goals, the United Nations point out that digital finance is a great equaliser, providing the unbanked with access to digital payments, credit, and micro-insurance while allowing households to manage costs associated with health, education and utility payments.

For financial institutions and governments, digital wallets help to establish credit histories for previously unbanked consumers.

This in turn enables the launch of micro-lending, mortgages and other credit products that help to further engage individuals in the wider economy and promote economic growth.

By reducing the economy’s reliance on cash, McKinsey and Company say digital payments make transactions up to 40% cheaper and speed up transfers of value between individuals, businesses and governments.

More than this, there’s also clear evidence that digital payments boost overall economic development.

In Lebanon, for example, the introduction of digital wallets such as Purpl since 2020 has enabled faster and cheaper flows of funds between individuals, despite the financial crisis that engulfed the Lebanese banking sector between 2019 and 2021.

Meanwhile, Saudi Arabia has seen a 30% year-on-year growth in digital wallet use since their introduction in 2019 – and a correlated growth in the overall digital economy.

In mid-2022, the Saudi government announced that, for the first time, there were more electronic transactions than cash use in the Kingdom.

At NassWallet, we are enabling economic development for Iraqis through digital wallets and payment cards.

As one of the first organisations to launch a wallet in Iraq and a principal issuing member of the VISA network, we have created a digital wallet solution that enables users to pay peers (P2P transfers), make and receive government and utilities payments and access their cash at more than 1,000 agents across Iraq.

Given the importance of NGOs to economic recovery in our country, we’ve also created a specific version of our wallet for the donor community which allows them to track the disbursement of funds to guarantee donor money is allocated to its proper purpose

To find out more about how NassWallet is enabling economic growth and opportunity in Iraq, please visit: www.nw.iq