A scammer paid Facebook’s parent company $7,000 to reach up to 100,000 people in Australia with a deepfake A Current Affair video featuring altered versions of Jim Chalmers, Dick Smith, Andrew Forrest and Gina Rinehart, data reveals.

Smith issued a warning to the public earlier this week after a video began circulating on Facebook and Instagram in recent weeks. The video was designed to appear like a segment on A Current Affair, featuring host Ally Langdon seemingly interviewing the treasurer and the rich listers about an investment opportunity.

It is the latest iteration of the celebrity scam investment ads that have plagued social media sites and Google’s AdWords for years. The previous version used photographs linked to fake news pages, but the current ads use deepfake videos that not only match the images of the people they are faking, but also replicate their voices.

Dick Smith criticises Facebook after scammers circulate deepfake video adRead more

In the video, the fake Chalmers claims the government has gone as far as tabling a report in parliament talking about the success of a particular investment, which is in fact a scam. It claims the “government guarantees and recommendations from the treasury! Start with $349 and withdraw $7,200 every week!”.

Smith said on his website: “It is totally fraudulent. The scammers have made up the voice and lip-synced to make it look genuine.

“Do not open it and do not send any money. It is a scam.”

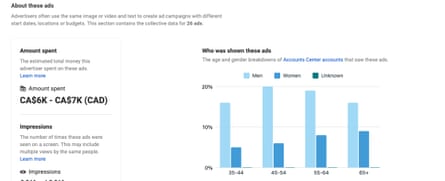

The Facebook ad library data reveals the amount the scammers paid in Canadian dollars. They spent between CAD$6,000 and $7,000 (A$7,700) across 26 ads between 23 and 28 November to reach up to 100,000 impressions on Facebook. The figure amounts to approximately 7 cents per view.

View image in fullscreenFacebook data shows how much was spent by scammers on the celebrity investment scam ads. Photograph: Facebook

View image in fullscreenFacebook data shows how much was spent by scammers on the celebrity investment scam ads. Photograph: Facebook

The statistics reveal that men were more likely to see the ad than women, while those over 45 were more likely to see the ad than those aged 35 to 44.

It is rare for these types of scam ads to appear in Facebook’s ad library, which the company publishes for transparency. Ads generally only appear in the transparency library if they are related to a political issue. Facebook does not include every type of ad it takes money from, and scam ads would not normally be included.

Facebook may have automatically labelled the ad as political due to the inclusion of the treasurer. Several ads were flagged by Meta as running “without a required disclaimer”, which is usually associated with political ads.

After Guardian Australia contacted Meta about the ads, the account promoting the ads was removed.

Meta did not answer questions about the amount of money earned from scam ads overall, but a spokesperson said the company was “constantly tackling scams through a combination of technology, such as new machine learning techniques and specially trained reviewers, to identify content and accounts that violate our policies”.

“We are currently also working across industries and with the government to identify new ways to stop scammers.”

Australian losses to online marketplace fraud increase as scams become increasingly sophisticatedRead more

The Meta spokesperson said people should report scams when they see them and contact law enforcement if they fall victim to such scams.

According to data from the Australian Competition and Consumer Commission’s Scamwatch, Australians have reported losing $53.3m to investment scams via social media this year, with more than 1,200 reports to the end of October.

An ACCC spokesperson said the government’s national anti-scam centre alerts Meta to remove scams when it is made aware of them.

“We expect digital platforms to prevent scam ads being shown to consumers and to ensure internal reporting pathways allow users to report scam ads that make it through any initial vetting for prompt removal,” the spokesperson said.

Meta is facing two lawsuits over the celebrity investment scam ads – a criminal case brought by Forrest in Western Australia and a civil case brought by the ACCC.

The federal court in October rejected Meta’s attempt to have the ACCC case delayed while the Forrest criminal case is heard in Western Australia. Meta argued the civil case could prejudice the criminal case, but in reasons published this week, federal court justice Elizabeth Cheeseman ruled the move was premature and that potential issues could be managed.

Both cases are expected to be heard next year.